Gusto: Simplifying The Payroll Process For SMBs, And Beyond

Last update at December 5, 2023

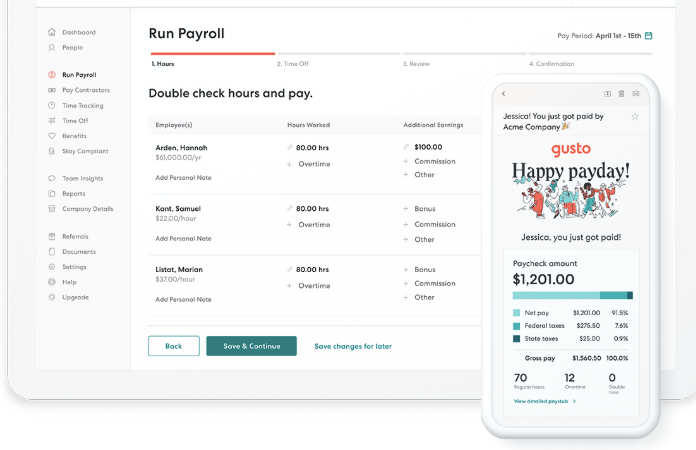

Did you know that small business owners spend an estimated five hours per pay run on facilitating payroll activities? This adds up to a staggering 21 days annually – which could have been significantly reduced when the correct platform was chosen to facilitate these actions. Payroll usually includes costs such as salaries, wages, freelancer payments, bonuses, and benefits, as well as taxes, and other administrative tasks. It can be frustrating to stay up to date with every transaction method or action, especially when there is simply not enough time to do everything manually. This is where a payroll solutions provider such as Gusto comes in. Our article today focuses on how Gusto can make payroll services a breeze – not only as a cost-effective platform but also as an easy-to-use software where business owners will have no problem staying ahead with their financial responsibilities.

A top-rated platform chosen by over 300,000 businesses

Gusto stands out immediately as an accessible platform that can be used by businesses of any size. Its well-deserved credit as an “all-in-one HR platform” is due to how it is truly a one-stop shop for hiring, paying, and managing staff through a streamlined online provider. In just a couple of clicks, Gusto can solve many pain points that employers might have when it comes to payroll. Let’s review five of the main advantages that this payroll services provider offers.

Top 5 Gusto solutions that employers can benefit from immediately

-

Accurate, correct data for all employees

With Gusto, all your company information is kept in one place. All staff, whether permanent, part-time, or seasonal, are classified correctly and their data is captured accurately. This means that you never need to worry that you misclassify a staff member – or that they will lose out on benefits due to incorrect administration.

-

Automation that saves time – allowing you to focus on what is important

Over and above potential errors, manually entering payroll information can take hours away from an employer’s schedule. However, with Gusto’s set of tools, anything from working hours, overtime, and leave requests to holidays and PTO can be quickly captured. This means extra time to focus on other business functions, without worrying about payroll actions that would otherwise have taken considerable time to action.

-

An easy way to keep your business compliant

Around 37% of small businesses and gig workers have experienced anxiety and confusion when it comes to filing taxes. With Gusto, any uncertainty is removed. The platform can automatically assist you in filing taxes, as well as help you stay compliant and on top of registrations in all 50 states. This not only adds convenience for employers in small businesses but also eliminates IRS fees for errors.

-

Integration with all relevant systems

Thanks to its overarching functionality, Gusto can integrate various systems, including time-tracking software, and recruiting software, as well as other apps used by a business such as Asana and Autobooks. This integration means business owners can easily sync data immediately, with no lag in time that could cause errors. At any point in time, an employer can easily reference the latest data, with the peace of mind that company information is always up to date.

-

A trustworthy online solution that always keeps your data safe and secure

Gusto ensures that your data is always backed up. There is minimal risk of information being lost, and with its cloud approach, you can access your company profile from any location at any given time. This means that Gusto eradicates the risk of losing valuable information, ensuring that you never need to start from scratch to update systems.

Why Gusto just makes sense as a payroll solutions provider

From saving businesses up to five hours monthly and saving costs to any easy application that you can switch to in two weeks or less, Gusto makes payroll easy. If you are ready to break free from typical payroll headaches and frustrations, why not visit Gusto today? There are three plans available to choose from, which include simple, plus, and premium (the latter allowing for custom pricing and benefits).

Choose your perfect fit today and get ready to tap into all the benefits of streamlined, perfect payroll solutions.